You are here:Chùa Bình Long – Phan Thiết > chart

Bitcoin Halving Price Rise: The Impact of Halving on Cryptocurrency Market

Chùa Bình Long – Phan Thiết2024-09-22 01:23:53【chart】7people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin halving, a significant event in the cryptocurrency world, has always been a topic of great i airdrop,dex,cex,markets,trade value chart,buy,Bitcoin halving, a significant event in the cryptocurrency world, has always been a topic of great i

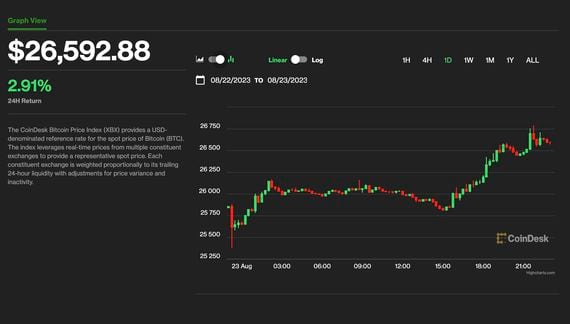

Bitcoin halving, a significant event in the cryptocurrency world, has always been a topic of great interest among investors and enthusiasts. The next halving event is scheduled to occur in 2024, and many are curious about its potential impact on the price of Bitcoin. In this article, we will explore the concept of Bitcoin halving, its history, and the expected price rise following the halving event.

What is Bitcoin Halving?

Bitcoin halving is a process in which the reward for mining a new block is halved. This event occurs approximately every four years and is a fundamental feature of the Bitcoin protocol. The purpose of Bitcoin halving is to reduce the rate at which new Bitcoin is created and to control the inflation rate of the cryptocurrency.

The first Bitcoin halving took place in 2012, reducing the block reward from 50 BTC to 25 BTC. The second halving occurred in 2016, further reducing the block reward to 12.5 BTC. The third halving happened in 2020, and the block reward was reduced to 6.25 BTC. As the block reward continues to decrease, the supply of new Bitcoin will eventually reach zero, which is expected to happen around the year 2140.

The Impact of Bitcoin Halving on Price

Historically, Bitcoin halving has been followed by a significant price rise in the cryptocurrency market. The reasons behind this trend are multifaceted.

Firstly, the reduced supply of new Bitcoin creates scarcity, which can drive up the price. As the block reward decreases, the number of new Bitcoin entering the market also decreases, leading to a more limited supply. This scarcity can make Bitcoin more attractive to investors, as they may perceive it as a more valuable asset.

Secondly, Bitcoin halving has been associated with increased interest from institutional investors. These investors often view Bitcoin as a digital gold, and the halving event is seen as a bullish sign for the cryptocurrency. As a result, institutional investors may increase their Bitcoin holdings, further driving up the price.

Lastly, the anticipation of the halving event itself can create a speculative bubble, leading to a price rise. As the event approaches, investors may rush to buy Bitcoin, anticipating a price increase. This speculative behavior can lead to significant volatility in the market.

The Expected Price Rise Following the Next Halving

With the next Bitcoin halving scheduled for 2024, many are predicting another price rise. Based on historical trends, the price of Bitcoin could potentially increase by a factor of two or more following the event.

However, it is important to note that the cryptocurrency market is highly unpredictable, and several factors can influence the price of Bitcoin. These factors include regulatory changes, technological advancements, and global economic conditions.

In conclusion, Bitcoin halving has historically been followed by a price rise in the cryptocurrency market. The reduced supply of new Bitcoin, increased interest from institutional investors, and speculative behavior can all contribute to a price increase following the halving event. While the next Bitcoin halving is expected to have a positive impact on the price of Bitcoin, it is essential to consider the various factors that can influence the market and exercise caution when investing in cryptocurrencies.

This article address:https://www.binhlongphanthiet.com/btc/26e64199332.html

Like!(7)

Related Posts

- Binance USD Withdrawal: A Comprehensive Guide to Secure and Efficient Transactions

- Check Amount in Bitcoin Wallet: A Comprehensive Guide

- How Can I Invest in Bitcoin?

- Binance Historical Price: A Comprehensive Analysis

- Do I Have to Report Bitcoin Wallet Ownership?

- Adding Bitcoin to Your Wallet Using ACH Payment: A Step-by-Step Guide

- Mega Bitcoin Mining Fully Registered Download Free: Unleashing the Power of Cryptocurrency Mining

- Binance Chain Mainnet: Revolutionizing the Blockchain Ecosystem

- The Rise of $100 Bitcoin on Cash App: A Game-Changer for Cryptocurrency Users

- Bitcoin Litecoin Mining Hardware: A Comprehensive Guide

Popular

- Can Windows Defender Detect Bitcoin Miner?

- In the annals of digital currency history, the year 2011 stands out as a pivotal moment for Bitcoin, the world's first decentralized cryptocurrency. This article delves into the fascinating journey of Bitcoin's price in 2011, highlighting the dramatic fluctuations and the factors that influenced its trajectory.

- Bitcoin Cash Address Generator: A Comprehensive Guide

- What Price Was Bitcoin When Tesla Bought?

Recent

Bitcoin Price Early 2017: A Look Back at the Cryptocurrency's Rapid Rise

**Fund Bitcoin Wallet with PayPal: A Comprehensive Guide

Bitcoin Litecoin Mining Hardware: A Comprehensive Guide

Bitcoin Price Week 2019: A Look Back at the Volatile Journey

Bitcoin Price Chart March 2017: A Look Back at the Cryptocurrency's Rapid Rise

Best Way to Get into Bitcoin Mining

**The Rise of Wallet Investor Bitcoin Gold: A New Era in Cryptocurrency Storage

Can I Change My Bitcoin to Cash?

links

- Binance US Bitcoin Futures: A Comprehensive Guide to Trading Bitcoin on Binance US

- El Bitcoin Cash Precio: A Comprehensive Analysis

- Bitcoin Price Fluxuation: Understanding the Volatility of the Cryptocurrency Market

- El Bitcoin Cash Precio: A Comprehensive Analysis

- Binance Wallet Swap: A Game-Changer in Cryptocurrency Trading

- What Was the Price of Bitcoin: A Journey Through the Cryptocurrency's Volatile History

- The Current State of the MCAP Bitcoin Price: A Comprehensive Analysis

- How to Convert USD to USDT on Binance US: A Step-by-Step Guide

- El Bitcoin Cash Precio: A Comprehensive Analysis

- El Bitcoin Cash Precio: A Comprehensive Analysis